5 benefits of a 401(k) plan

by Admin

Posted on 17-06-2023 12:27 PM

Achieving your retirement dreams won’t happen by accident. In order to live the retirement lifestyle you dream about, you must start saving. Your company’s retirement plan can be one of the best tools available to help you build your financial future, especially if you are a new investor.

For many, putting aside even a small percentage of your paycheck may feel like it will make a large impact to your financial situation when you are first deciding on a realistic contribution rate. Here are 5 benefits of most traditional 401(k) plans:.

For many, putting aside even a small percentage of your paycheck may feel like it will make a large impact to your financial situation when you are first deciding on a realistic contribution rate. Here are 5 benefits of most traditional 401(k) plans:.

The 401(k) is a very popular investment vehicle for retirement planning. Participating individuals gain valuable tax advantages as they set aside a portion of their salaries to their 401(k) accounts with some getting matching contributions from their employers. As much as $6. 3 trillion was held in these plans as of september 2022. More than half of the money invested in these employer-sponsored plans was set aside in mutual funds while the rest was put into other investments. There are many reasons why investors and retirement savers rely on their 401(k) plans. Let's take a look at the benefits and advantages of the 401(k). https://dsl.z20.web.core.windows.net/401krolloverguide/401K-Retirement-Plan/Benefits-of-401-k-Retirement-Plans-Tax-Implications-Employer-Contributions-and-Answering-the-Top-Five-Questions-Solved.html

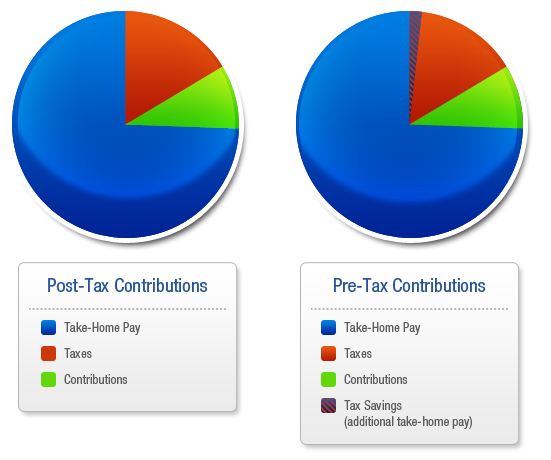

The main benefit of 401(k) plans is that they allow retirement savings to grow tax deferred. But there are more advantages, especially in comparison to individual retirement accounts (iras). Read on for these less-known 401(k) benefits – plus for info about the newer roth 401(k). Wish you were more retirement ready? a financial advisor can help. Legislation in 2019 and 2022 has expanded access to workplace retirement plans. Here’s what you need to know about the popular savings vehicle.

Topic index.

Regulatory summary of fidelity's services keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money. Fidelity interactive content services llc ("fics") is a fidelity company established to present users with objective news, information, data and guidance on personal finance topics drawn from a diverse collection of sources including affiliated and non-affiliated financial services publications and fics-created content. Content selected and published by fics drawn from affiliated fidelity companies is labeled as such. Fics selected content is not intended to provide tax, legal, insurance or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by any fidelity entity or any third-party.

Vanguard situational advisor allows you to consult an advisor at 800-310-8952 to get point-in-time financial advice on a specific topic, at no cost to adobe employees. Topics might include retirement planning, buying a house, saving for college or any other financial situation you may be facing.

Just as workers should plan for their future, so should business owners. However, many don't. According to 2019 research from score , 34 percent of small-business owners said they did not have retirement savings plans for themselves, and 40 percent of business owners said they were not confident that they would be able to retire before the age of 65. There's also the notion that small-businesses owners don't want to retire , and therefore don't need to save because they will always work. But circumstances outside of their control, like illness, may make a situation without a savings or exit plan challenging.

Leaving your 401k with your former employer may be the best choice if you’re happy with the investment options and fees offered by the plan. Another advantage of leaving your 401k behind is that you won’t have to pay taxes on the money until you withdraw it. However, there are some potential drawbacks to this option as well. For one thing, you won’t have as much control over your retirement savings. And if your former employer goes out of business, your 401k could be lost or substantially reduced in value.

A solo 401k will allow you to make traditional as well as non-traditional investments. As trustee of the solo 401k plan, you will have "checkbook control" over your retirement assets and make the investments you want when you want.